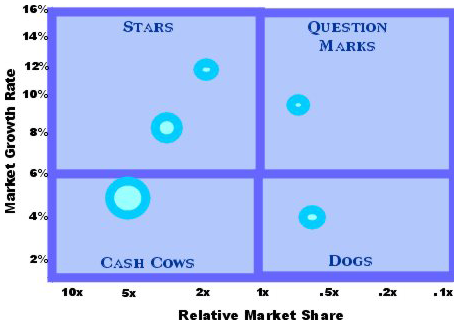

Boston Consulting Group Matrix

The BCG matrix is a strategic analysis tool designed by the Boston Consulting Group in the late 1960s, to optimizes long-term strategic planning in a company. Still widely used in business strategy, this matrix allows you to represent your business portfolio according to the growth of the targeted market and the relative market share of the company. This matrix places each business unit or company product into a matrix that has two axes, namely market share and market growth.

The matrix in practice

BCG matrix definition

This strategic and marketing tool is used to organize the portfolio of products and/or activities of a company. It is a graphical representation on two axes, the growth rate of the market (from weak to strong) in ordinates and the relative market share (from strong to weak) in abscissas. The attractiveness of the market and the competitive position of each product of the company, or of each field of activity, are therefore represented. This will make it possible to classify the products or Strategic business unit into four categories:

- Stars: strong market penetration and high market growth rate

- Cash cows: high market penetration and low market growth rate

- Question marks (dilemmas): low market penetration in a high growth market

- Dogs (dead weights) for low market penetration in a low-growth market

A strategic approach cannot be based entirely on the sole use of the BCG matrix. It is to be supplemented by other tools. In addition, other criteria can be integrated into the graphical representation (for example the size of the circles to represent the turnover of each product or business unit).

Fields of application and interests of the BCG matrix

It makes it possible to justify the allocation of resources assigned to a particular product or business unit and to operate a strategic reorientation to balance its portfolio and improve performance both by strategic unit and globally.

It is a tool that can serve a company (in addition to other tools) at different times in its existence. In addition, the matrix accounts for the evolution of a product relative to its life cycle.

When creating a business, it can be used to map the target market and the positioning of competing offers.

Throughout the life of a company, the matrix represents at a given moment the positioning of a company’s offers compared to those of competitors (relative market share) and market attractiveness (market growth or sector).

By extension, marketing can use it to assess the balance of a product portfolio within the same business unit, in order to visualize which ones are profitable and which ones are struggling.

More broadly, in a competitive market, any company must constantly adapt to market developments and the positioning of its competitors. The BCG matrix will constitute a decision-making tool for the manager in order to follow this evolution and adapt his offer accordingly.

Matrix Interpretations

Each product or business unit will be categorized according to its location in the matrix. The idea, in order to optimize its cash flow, is to have a balanced portfolio where the cash cows and the stars will finance the dilemmas and the DOGS (dead weights) will be divested (reduction of some kind of asset for financial).

Cash cows

Cash cows are the company’s most profitable products. They hold a strong competitive position in a slow-growing and/or mature market. They require little new investment to maintain and ensure the immediate profit of the company. The cash can be used to finance other projects/products, especially those that fall into the “dilemmas” category.

The stars

They have a substantial market share in a strong growth market. They generate cash and are the future of the company. It may require high investments (financial, communication, etc.) to maintain their dominant position. They are not always the most profitable but they are destined to become cash cows when the market has matured, taking advantage of market saturation.

Question marks (dilemmas)

The dilemmas are in low market penetration in a high growth market. They are jostled (to come in contact or into collision) by the intensity of competition in a promising market, but do not manage to hold their own. Their future is uncertain and the question that the company must solve (with other complementary tools such as market research, the Pestel analysis or the SWOT) is that of their maintenance, and with what levels of investment, or of their withdrawal.

Dogs (Deadweights)

Deadweights are characterized by low market penetration in a low growth, mature or declining market. Their profitability is very low, if not zero. Financially, it is in the company’s interest to divest dead weights, or even remove them from their offer.

BCG Matrix Ian Dunster, English Wikipedia User, CC BY-SA 3.0, via Wikimedia Commons

Tool limitations

Not suitable for all business sectors: the analysis works on companies that develop a volume strategy based on the experience effect. This is not the case for all sectors, where profitability is not always correlated with market share. (Example: the luxury industry). Similarly, a dominant position in a market does not always imply significant profitability and is not in itself a key success factor.

The self-financing strategy between the different business unit or products implied by the matrix does not take into account possible external financial resources (loans, investors, issue of shares, etc.).

Does not take into account existing synergies between business unit or products. Economies of scale may exist between them and some unprofitable products (example: coffee machine) may lead to the sale of other products (branded pods).

Example of BCG Matrix: a concrete case

Creating a BCG matrix implies having certain information for each product or business unit:

- the growth rate of the targeted market

- the company’s market share

- the average market share of the main competitor

- the company’s relative market share (calculated by dividing the company’s market share by that of its main competitor)

- the income generated by each product or business unit

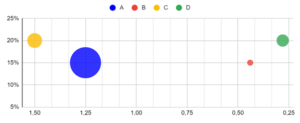

We will represent the product portfolio of the company AirRobots which markets 4 types of drones.

Let’s suppose that two drones (“A” and “B”) are sold to professionals and that the other two (“C” and “D”) are sold to individuals.

- Professional drone market growth rate: 15%

- Private drone market growth rate: 20%

[example and fictitious figures]

Drone “A” market share: 15% / main competitor: 12% (PMR = 1.25)

Drone “B” market share: 7% / main competitor: 16% (PMR = 0.44)

“C” drone market share: 12% / main competitor: 8% (PMR = 1.5)

“D” drone market share: 4% / main competitor: 14% (PMR = 0.28)

AC: A=400, B=80, C=120, D=100

It is very clear that drone “A” is the cash cow, but in a market not yet mature. “C” is the future star. “D” is a dilemma and “B” tends to be (relative) dead weight.

Sources: CleverlySmart, PinterPandai

Photo credit: via Pixabay